4 October, 2021

32 Hours Online + 18 Hours Homework

€ 2450

The FinTech course will cover the most relevant trends (Open Banking, Conversational AI, Digital Payments) and the underlying technologies in the financial services sector, with an outlook for the future developments. It will be enriched with examples of the powerful technology applications and the validated use cases from different geographies across the globe showcasing how the successful FinTech strategies can be implemented.

The course is designed for anyone willing to keep up with the pace of the change in the FinTech sector, starting from the investors interested in the recent FinTech developments, the corporate executives eager to learn more about financial services innovation to the startup founders wondering what is the next big thing in banking and payments.

FinTech continues to mature and give rise to several vital trends shaping the industry (Open Banking, Digital Payments). It is one of the most innovative tech sectors nowadays, transforming the way we interact with banking and payment services.

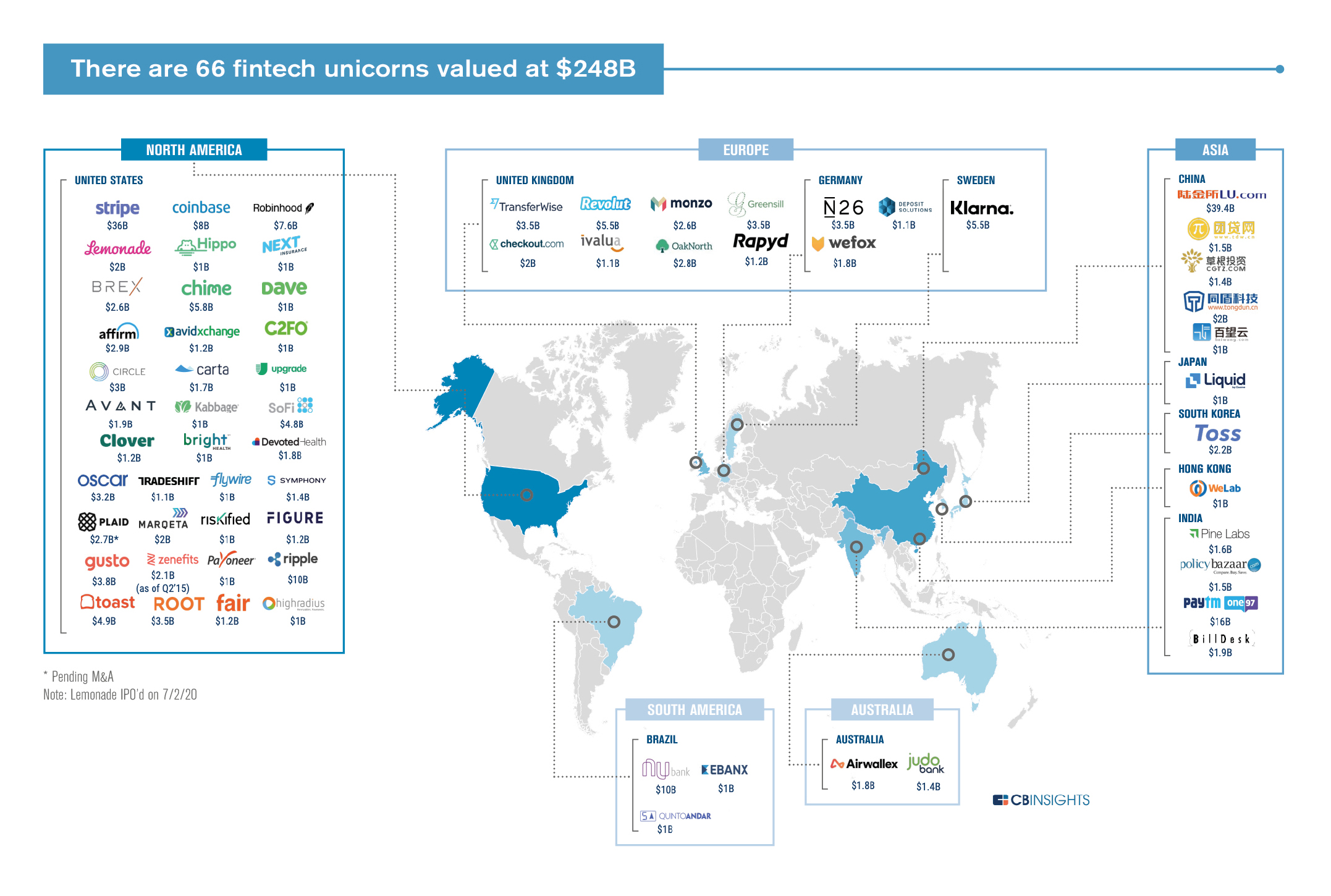

FinTech mega-rounds ($100M+) hit a new quarterly high of 28 (Q2 2020) as the largest companies in the space raised additional funding. There are 66 VC-backed FinTech unicorns worth a combined $248B.

That’s why it is important to join this FinTech journey.

The course is designed for:

What are the driving forces enabling FinTech to mature and grow?

In this module we will discuss the driving forces enabling FinTech industry to mature and grow, looking from the social and technological angles as well as through the lens of the regulatory frameworks. Social indicators such as mobile growth (mobile first), data consumption, as well as technology enablers - including the rise of (the) messaging and voice platforms and quantum computing - will be covered. The regulatory landscape, a source for innovation in the financial services, will also be presented based on the selected international markets.

Presentation by the lecturer: 60 min

Q&A: 15 min

What are the most relevant trends and recent developments?

In this module we will discuss the most recent and important trends in FinTech (developments) as well as the key technologies underlying FinTech solutions (Open APIs, AI, etc). The applications of the innovative technologies, together with the examples of the use cases and companies (banks, fintechs, big techs) providing them in banking and payments will be showcased.

Presentation by the lecturer: 120 min

Q&A: 20 min

What is needed to successfully implement FinTech solutions?

In this module we will discuss how to successfully implement the FinTech strategies, particularly taking a closer look at the validated business models and implementation scenarios executed by (the) different FinTech ecosystem stakeholders. We will also dive deeper into the cooperation models, including partnerships established between incumbents and FinTech startups. A separate workshop session (case study) dedicated to the bank-fintech collaboration and successful FinTech strategies is a vital part of this module.

Presentation by the lecturer: 120 min

Workshop (case study): 120 min

Who is driving the change and attracting (the) private money? What is hot for investors in FinTech?

In this module we will look at the FinTech sector (landscape) from the private funding perspective, its investment size and scale, the major deals including M&A transactions, the most interesting FinTech areas and companies attracting investors, the mega-rounds across different geographies around the globe. The FinTech unicorns will also be showcased.

Presentation by the lecturer: 60 min

Q&A: 15 min

Entrepreneurs-in-Residence accepted for the WIPA Start-up Exchange Programmes are awarded a professional certificate featuring their proficiency level on global entrepreneurship and a personal WIPA Identity Card.