Start-up Investment Promotion Collaboration Programmes (WFDI)

for Governments and FDI Bodies

The objectives of investment promotion agencies (IPAs) and economic development boards (EDBs) are changing rapidly. The number of mandates covered by IPAs and EDBs is growing, and new trends are emerging in the start-up and innovation economy around the world, but foreign direct investment (FDI) has been slowing down. To remain competitive, IPAs and EDBs will need to adapt to an ever-changing environment. They will need to optimize their performance by positioning themselves in the fast-growing start-up value chain.

The Global Start-up Investment Promotion Agency (WIPA) will identify opportunities for IPAs and EDBs in early and post-early stage equity and capital markets to leverage a country’s FDI capacity. WIPA will also explore innovative ways to develop collaboration between IPAs, EDBs and cross-border investors such as private equity funds, wealth management institutions, angel investor groups, corporate ventures and VCs, thus expanding co-investment opportunities. In addition, WIPA will bridge between current trends in the global start-up and innovation chain and local FDI bodies, to boost world class investments for local start-ups and scale-ups.

- How can start-ups and scale-ups contribute to FDI growth? Foreign direct investment in SMEs from start-up to scale-up to exit to boost cross-border investments

One of the biggest contributors to alternative investment markets is the start-up investment phenomenon, which has taken hold globally to become a game changer for the world economy. With increasing numbers of people turning into entrepreneurs, policymakers have realized the potential of start-ups in the growth of the economy, and they have produced various schemes that encourage start-ups by making it easy for foreign investors to venture into their start-up ecosystem.

The role played in the past by small-scale industries has been overtaken by start-ups. Economy administrators and policymakers have been making the process easier for the young entrepreneurs, start-ups and scale-ups that have the potential to attract foreign direct investment.

The surge in FDI will also go a long way in encouraging the booming start-up scene around the world. In fact, investors worldwide who have been keeping an eye on start-ups and scale-ups see that start-ups are generating a diverse range of innovative ideas. Governments have been supportive of the growth and have devised numerous strategies to support the start-up. FDI can nudge the efforts of the government in the right direction by funding company s start-ups at different funding stages, ranging from seed investment to the multi-Em rounds that scale-ups can command. Many entrepreneurs with a great idea, who currently lose out on funding, might find assistance through FDI. And this will give an excellent opportunity to the FDI industry to leverage its investment size and capacity.

In line with such benefits – and in order to give a fillip to foreign investment in start-ups – India, for example, through its Consolidated FDI Policy 2017, has allowed foreign venture capital investors to contribute up to 100% of the capital of start-ups, irrespective of sector. The investment can be made in equities or equity-linked instruments, or debt instruments issued by the start-ups, and if a start-up is organized as a partnership firm or an LLP, the investment can be made in the capital or through any profit-sharing arrangement. Special provisions specific to start-ups have been created for the specifically to attract FDI.

- Next Step to join the Programme:

WIPA assists FDI bodies to develop better policies to leverage FDI capacity of their countries: The reasons why entrepreneurs, co/founders of early stage companies and SMEs shareholders might want to participate in programmes offered by the WIPA are- What types of national investment policy can be developed to attract more and higher quality investments in the start-up investment ecosystem

- What factors determine how successfully IPAs and EDBs are able to attract more investment

- How early-stage equity markets can contribute to main FDI players (investment promotion agencies and economic development boards) through angel investors

- How early-stage capital markets can contribute to increase FDI capacity of a country through angel investment funds, private equity funds, corporate venture capital and wealth management institutions such as family offices.

Joining the programmeWBAF believes that global collaboration offers a great opportunity to governmental and semi-governmental institutions such as economic development boards, regional development agencies, investment promotion agencies, chambers of commerce and industry, business councils, government ministries, SME development agencies, innovation agencies, technology transfer offices, techno parks and economic development departments of municipalities to discover the real power of start-ups and businesses to empower their economies through innovation, angel investment and entrepreneurship.

With this in mind, the World Business Angels Investment Forum signs comprehensive economic collaboration MOUs with governments and institutions to create more opportunities in their respective countries for all manner of start-ups, growth companies, scale-ups, as well as SMEs and other high-growth businesses. Any governmental institution signing an MOU with the World Business Angels Investment Forum will be able to benefit from the Start-up Investment Promotion Collaboration Programmes.

Please send an email for a zoom meeting about the MOU signing process:

Christina Mc Gimpsey - Secretary General, World Business Angels Investment Forum

Christina.McGimpsey@wbaforum.org- Hosting WBAF’s investor delegations at their countries

- Hosting Global Fundraising Stage at their countries

- Featuring local entrepreneurs on the Global Fundraising Stage

- Featuring local entrepreneurs on the World Class Start-up Magazine

- Coordinating WIPA’s accreditation framework for incubation centres and co-working spaces

- Easing access to WIPA’s Start-up Exchange Programmes for local entrepreneurs

- Easing access to world-class investments for national start-ups,

- Introducing new markets for local entrepreneurs,

- Next Step to join the Programme:

- How can start-ups and scale-ups contribute to FDI growth? Foreign direct investment in SMEs from start-up to scale-up to exit to boost cross-border investments

One of the biggest contributors to alternative investment markets is the start-up investment phenomenon, which has taken hold globally to become a game changer for the world economy. With increasing numbers of people turning into entrepreneurs, policymakers have realized the potential of start-ups in the growth of the economy, and they have produced various schemes that encourage start-ups by making it easy for foreign investors to venture into their start-up ecosystem.

The role played in the past by small-scale industries has been overtaken by start-ups. Economy administrators and policymakers have been making the process easier for the young entrepreneurs, start-ups and scale-ups that have the potential to attract foreign direct investment.

The surge in FDI will also go a long way in encouraging the booming start-up scene around the world. In fact, investors worldwide who have been keeping an eye on start-ups and scale-ups see that start-ups are generating a diverse range of innovative ideas. Governments have been supportive of the growth and have devised numerous strategies to support the start-up. FDI can nudge the efforts of the government in the right direction by funding company s start-ups at different funding stages, ranging from seed investment to the multi-Em rounds that scale-ups can command. Many entrepreneurs with a great idea, who currently lose out on funding, might find assistance through FDI. And this will give an excellent opportunity to the FDI industry to leverage its investment size and capacity.

In line with such benefits – and in order to give a fillip to foreign investment in start-ups – India, for example, through its Consolidated FDI Policy 2017, has allowed foreign venture capital investors to contribute up to 100% of the capital of start-ups, irrespective of sector. The investment can be made in equities or equity-linked instruments, or debt instruments issued by the start-ups, and if a start-up is organized as a partnership firm or an LLP, the investment can be made in the capital or through any profit-sharing arrangement. Special provisions specific to start-ups have been created for the specifically to attract FDI.

- Incorporating new types of investments for local economies

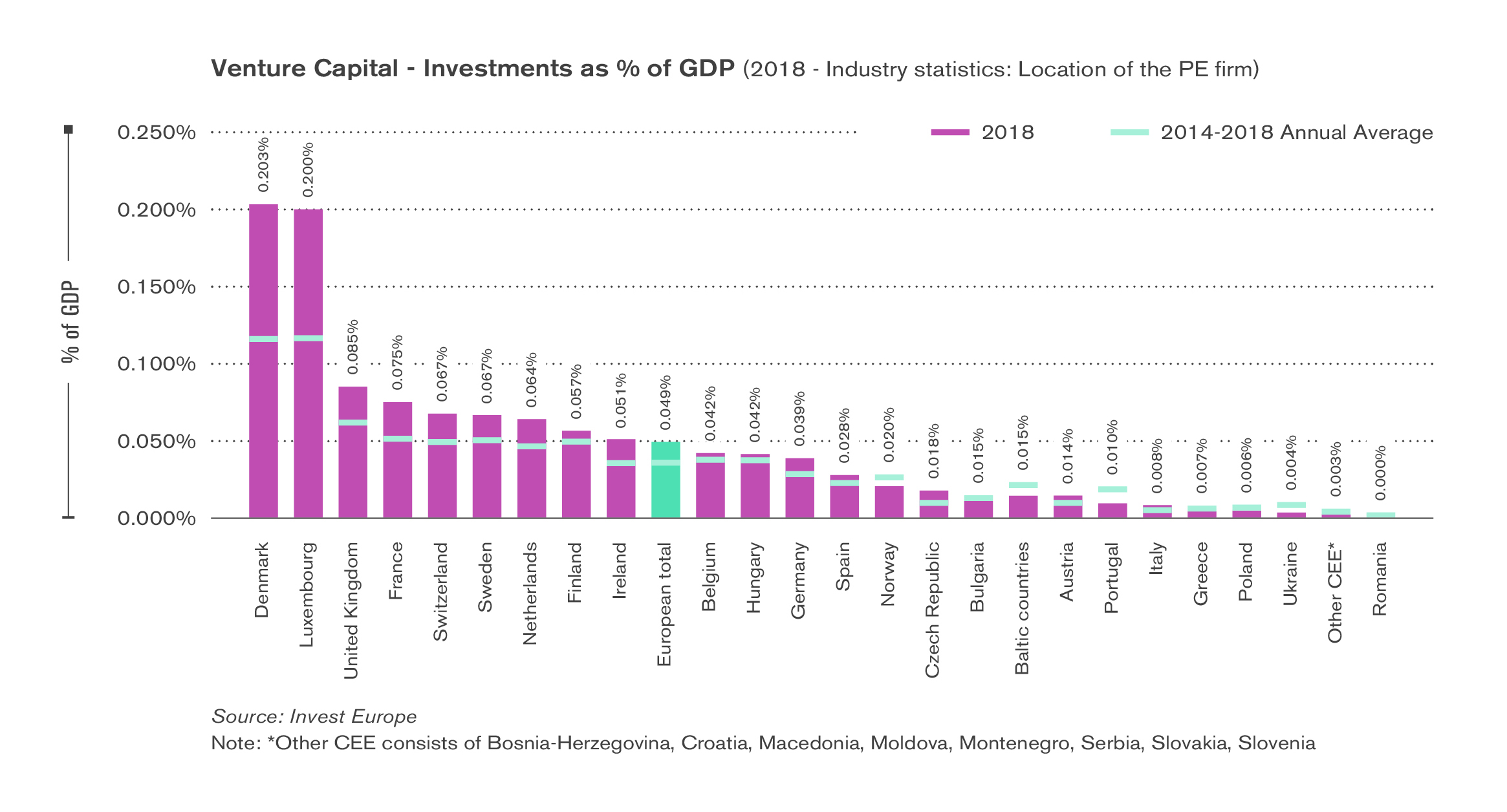

New types of investments, such as Venture Capital (VC), Corporate Venture Capital (CVC), Sovereign Wealth Funds (SWF), family offices, and impact investments, are offering new opportunities for countries to boost their development. For example, concepts of financing emerging companies with high growth potential, i.e. start-ups, known as VC or CVC investments are at record levels despite negative global FDI trends. Global analysis of venture funding by KPMG revels continues six-year straight growth of VC reaching $254 billion in 2020. Additionally, corporate participation in VC deals, i.e. CVC, reached an all-time high, where corporations participated in 20% of all VC deals in 2020.

Furthermore, although SWF are growing less rapidly than before, they are still playing a significant role in global capital markets. Another emerging source of investment is family offices. According to EY sources, there are more than 10,000 single family offices worldwide. These investors are particularly engaged with impact investment strategies, and tend to place great emphasis on ethical investing and achieving a positive social impact as a result of the investments they make

WIPA gathers experts to assist governments on the main pros and cons of these new types of investments. For example these people can assist in answering questions such as

- How governments can create fertile environment for creation of start-ups and utilize opportunities that VC investing is offering

- How start-ups can go about capturing the attention of CV and CVC investors

- Which key factors are driving Sovereign Wealth Funds and family offices to invest

- What is the future of impact investments?

- Benefits to FDI Bodies

- Creating National Champions of their start-up ecosystems,

- Easing access to quality education, mentorship, coaching and consultancy for local entrepreneurs,

- Accelerating the life cycle of early stage companies by compressing WBAF’s years’ worth of learning-by-doing into just a few months,

- Optimising their performance by positioning themselves in the fast-growing start-up value chain,

- Leveraging the competitive advantages of investment promotion agencies and economic development boards in global start-up value chain,

- Increasing foreign direct investment in SMEs from start-up to scale-up to exit to boost cross-border investments,

- Leveraging their investment size and capacity,

- Delivering WBAF ID Cards to citizens as an official WIPA National Center.